A Beginner’s Guide to Forex Trading: Unlocking the World of Currency Exchange

The Forex market is an exhilarating and fast-paced environment that attracts millions of traders worldwide. If you’re a beginner, navigating the intricacies of this market may seem daunting. However, with the right information and resources, you can start your forex trading journey with confidence. For additional insights and support, check out forex trading beginners https://trading-bd.com/ which offers a wealth of resources for aspiring traders.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies on the foreign exchange market. It is the largest financial market globally, with an average daily trading volume exceeding $6 trillion. Unlike stock markets, the forex market operates 24 hours a day, five days a week, providing ample opportunities to trade.

Key Concepts in Forex Trading

Currency Pairs

In Forex trading, currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the base currency, while the second is the quote currency. The price of the pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

Pips and Lots

Forex prices are typically quoted in pips, which are the smallest price movement that a given exchange rate can make based on market convention. A standard lot in forex trading represents 100,000 units of the base currency. There are also mini lots (10,000 units) and micro lots (1,000 units) that cater to different trading styles and account sizes.

Selecting a Trading Platform

Choosing the right trading platform is crucial for your success in forex trading. A reputable broker should offer a user-friendly interface, advanced charting tools, and a wide range of currency pairs. Additionally, consider their fees, trading spreads, and customer service options before making a decision.

Fundamental vs. Technical Analysis

Fundamental Analysis

Fundamental analysis involves the examination of economic indicators, news events, and geopolitical factors that can influence currency movements. Traders often monitor interest rates, employment figures, and inflation data to ascertain overall economic health and make informed trading decisions.

Technical Analysis

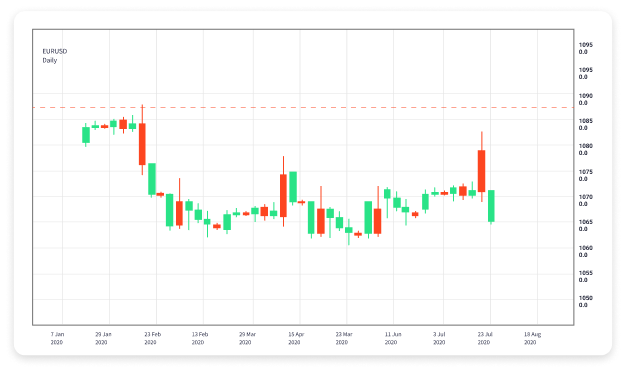

Technical analysis, on the other hand, focuses on historical price movements to predict future performance. This method utilizes charts and various technical indicators, like moving averages and relative strength indices, enabling traders to identify trends and potential entry or exit points.

Developing a Trading Strategy

A solid trading strategy is essential for success in forex trading. Here are some actionable steps to develop your strategy:

- Set Your Goals: Define your trading objectives, such as profit targets and acceptable risk levels.

- Choose Your Preferred Currency Pairs: Focus on a few currency pairs to develop a deeper understanding of their behavior.

- Select Your Trading Style: Determine whether you prefer day trading, swing trading, or position trading, depending on your availability and risk tolerance.

- Risk Management: Always use stop-loss orders to limit potential losses and protect your capital.

Practicing with a Demo Account

Before diving into live trading, consider opening a demo account with your chosen broker. This allows you to practice your trading strategies in a risk-free environment using virtual currency. It helps you get familiar with the platform, test different trading strategies, and build your confidence.

Staying Informed

Keeping up with market news and trends is vital for forex traders. Follow financial news networks, subscribe to forex news websites, and participate in trading forums to stay updated. Always be on the lookout for economic reports and potential market-moving events that could impact currency prices.

Common Mistakes to Avoid

As a beginner, it’s important to recognize common pitfalls in forex trading:

- Lack of a Trading Plan: Trading without a clearly defined plan can lead to impulsive decisions and losses.

- Overleveraging: Using excessive leverage can amplify gains but can also lead to significant losses. Use leverage wisely.

- Ignoring Risk Management: Failure to set stop-loss orders can result in devastating losses. Always manage your risks carefully.

Conclusion

Forex trading can be a rewarding venture with the potential for substantial profits. However, it requires dedication, continuous learning, and careful planning. By understanding the fundamentals, developing a solid trading strategy, and staying informed, you can navigate the forex market successfully. Remember, start small, practice diligently, and never stop learning as you embark on this exciting trading journey.