The Ultimate Guide to Forex Trading with Online Brokers

Forex trading has become increasingly popular in recent years, offering opportunities for investors around the globe. As you embark on your trading journey, the choice of an forex trading online broker India Brokers is crucial. In this guide, we will explore the essentials of forex trading, what an online broker offers, how to select one, and strategies to enhance your trading experience.

Understanding Forex Trading

Forex, or foreign exchange, is the largest financial market in the world. It involves the buying and selling of currencies with the aim of making a profit. Forex trading is conducted through brokers, who provide a trading platform where traders can execute their trades. Below are essential concepts every forex trader should understand:

Currency Pairs

In forex trading, currencies are quoted in pairs. The first currency is known as the base currency, and the second is the quote currency. For example, in the currency pair EUR/USD, the euro (EUR) is the base currency, while the US dollar (USD) is the quote currency.

Pips and Spread

A pip is the smallest price movement that a given exchange rate can make. It is typically the fourth decimal place in a currency pair. The spread is the difference between the bid price and the ask price, representing the broker’s profit. Understanding pips and spread is vital for determining the cost of your trades.

The Role of Online Brokers

Online brokers are intermediaries that facilitate your forex trading. They provide access to the forex market via trading platforms, offer tools to analyze market conditions, and often provide educational resources. The right broker can significantly impact your trading experience.

Choosing the Right Forex Broker

Selecting a reliable forex broker can be overwhelming given the multitude of options available. Here are some crucial factors to consider when making your choice:

Regulation and Security

The first step in choosing a broker is to ensure that they are regulated by a reputable financial authority. Regulations help protect your investment and ensure fair trading practices. Look for brokers that are regulated by entities like the Financial Conduct Authority (FCA), the Commodity Futures Trading Commission (CFTC), or the Australian Securities and Investments Commission (ASIC).

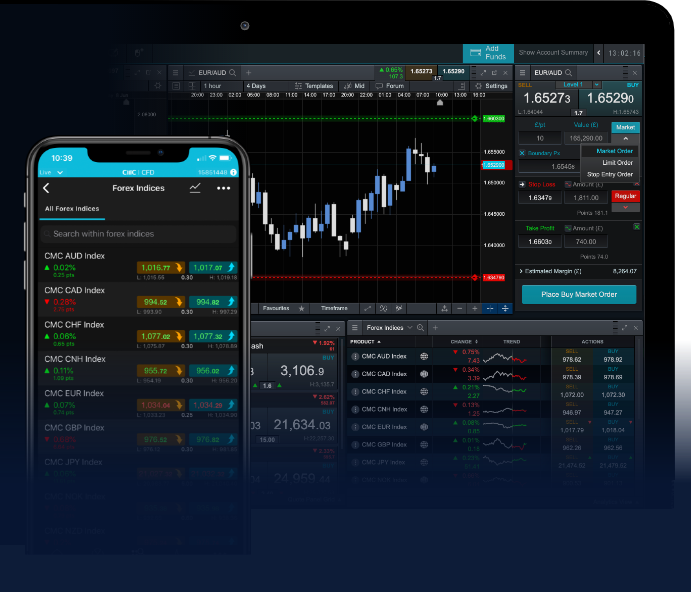

Trading Platform

The trading platform is the primary tool you will use for forex trading, so it is essential to choose a user-friendly and feature-rich platform. Many brokers offer popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which provide advanced charting tools and automated trading options.

Fees and Commissions

Different brokers have varying fee structures. Some may charge a commission per trade, while others may have a spread-only model. It is important to analyze the overall cost of trading with a broker, including any hidden fees, to ensure that it aligns with your trading strategy.

Customer Support

Good customer support is vital, especially for beginner traders who may have numerous queries. Look for brokers that offer 24/5 customer support through multiple channels, including live chat, email, and telephone.

Trading Strategies for Success

Once you have selected a reliable broker, it’s time to develop a trading strategy. Here are a few strategies that can help you optimize your trading performance:

Technical Analysis

Technical analysis involves analyzing price charts and using various indicators to forecast future price movements. Key indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. Understanding these tools can enhance your ability to make informed trading decisions.

Fundamental Analysis

This strategy focuses on analyzing economic indicators, news events, and geopolitical developments that may affect currency values. Keeping an eye on major economic announcements, such as interest rate changes or employment reports, helps traders anticipate market movements.

Risk Management

Effective risk management is essential for long-term trading success. This involves setting stop-loss orders, employing proper position sizing, and diversifying your trading portfolio. Never risk more than you can afford to lose, and ensure that your potential reward outweighs the risk.

Conclusion

Forex trading offers tremendous opportunities for profit, but it also comes with its own set of risks. Choosing the right online broker is crucial, as it lays the foundation for your trading success. By understanding the basics of forex trading, evaluating brokers based on key factors, and developing a robust trading strategy, you can enhance your chances of success in this dynamic market.

Regardless of whether you are a beginner or an experienced trader, always stay informed, continue to learn, and adapt to the evolving market conditions.