In the dynamic world of Forex trading, having a solid strategy is paramount. Traders explore various methods to enhance their understanding of market movements and maximize their trading profits. Whether you are a novice or a seasoned trader, knowing the right strategies can be a game-changer. For those looking for resources on Forex trading, forex trading strategies https://ex-zar.com/ serves as an excellent starting point to deepen your knowledge.

Understanding Forex Trading Strategies

Forex trading strategies are systematic methods used by traders to make informed decisions about buying and selling currencies. A well-structured strategy should take into account both technical and fundamental analysis while considering market psychology. This article will explore popular strategies including technical analysis, fundamental analysis, swing trading, scalping, and trend following.

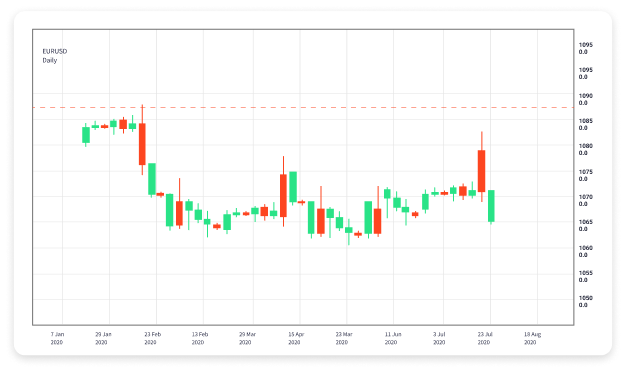

1. Technical Analysis

Technical analysis is the study of historical price movements and trading volumes to predict future market behavior. Traders utilize various tools, indicators, and chart patterns to identify potential trading opportunities. Some commonly used tools are:

- Moving Averages: These smooth out price data to identify trends over a specific period.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

- Bollinger Bands: These bands expand and contract based on market volatility, providing insight into potential trading setups.

By utilizing these indicators strategically, traders can identify entry and exit points, enhancing their decision-making process.

2. Fundamental Analysis

Unlike technical analysis, fundamental analysis focuses on economic indicators, news events, and geopolitical developments. Traders who employ this strategy believe that underlying economic fundamentals drive currency values. Key elements to monitor include:

- Interest Rates: Central banks influence currency strength through interest rate adjustments.

- Economic Indicators: Reports such as GDP, unemployment rates, and inflation figures provide valuable insights into economic health.

- Geopolitical Events: Political stability, elections, and international relations can affect currency perceptions and trading behavior.

By staying informed about these factors, traders can anticipate market movements and make strategic trades based on economic forecasts.

3. Swing Trading

Swing trading is a technique that involves holding positions for several days to capitalize on expected price movements. Swing traders utilize both technical and fundamental analysis to identify short- to medium-term opportunities. Key characteristics of swing trading include:

- Time Commitment: Swing trading requires less time than day trading, making it suitable for individuals with full-time jobs.

- Risk Management: Swing traders often use stop-loss orders to protect against significant losses.

- Market Trends: Identifying a strong trend allows swing traders to ride the momentum for potential gains.

This strategy demands patience and the ability to make swift decisions in response to market movements.

4. Scalping

Scalping is a high-frequency trading strategy that involves making numerous trades throughout the day, aiming for small profits on each one. Scalpers exploit minute price changes in the market, often holding positions for seconds to minutes. Important aspects of scalping include:

- Quick Execution: Scalpers require access to fast execution platforms to capitalize on quick price movements.

- Leverage: Utilizing high leverage can amplify profits but also increases the risk level.

- Market Focus: Scalpers typically focus on currency pairs with high liquidity to ensure they can enter and exit positions swiftly.

While potentially lucrative, scalping demands intense concentration and a continuous market presence.

5. Trend Following

Trend following is a strategy that involves identifying and trading in the direction of prevailing market trends. This approach relies on the belief that the market tends to move in trends and that these trends are likely to continue. Strategies for trend following include:

- Identifying Trends: Using trendlines and moving averages to recognize upward or downward trends.

- Momentum Trading: Buying when a currency shows upward momentum and selling during downward momentum.

- Risk Management: Implementing trailing stops to protect profits as the market moves in the desired direction.

Trend following strategies require discipline and the ability to stay invested during market fluctuations.

6. Combining Strategies

Many successful Forex traders combine elements from different strategies to create a unique approach tailored to their trading style. For instance, a trader might use technical analysis for entry and exit points while employing fundamental analysis for overall market context. This hybrid approach can help mitigate risks and improve decision-making.

Conclusion

In conclusion, developing a successful Forex trading strategy involves understanding various methods and consistently adapting to market conditions. Whether you prefer technical analysis, fundamental analysis, or a combination of both, the key is to remain disciplined and informed. By selecting and refining a trading strategy that suits your individual goals and personality, you can enhance your chances for success in the Forex market. Remember that trading carries risks, and continuous education is crucial for long-term achievements.